Project Description

Addresses: Buildings 2-3: 1001-1059 Foch Street. Building 1: 821-945 Foch Street.For my adaptive reuse case study I am considering the proposed properties and determining what the property should be developed as.

There are three buildings located just off of W.7th street in the cultural district / W 7th street corridor. It is just south west of the Montgomery Plaza and there are several new multistory multifamily apartments being built directly across from the proposed site.

Building 1 has approx 68,000 SF, Building 2 has 80,000 SF and building 3 has 14,300 SF. Currently the tenants of these three buildings include a Tex/Mex restaurant, a yoga studio, art supply store and offices.

I am proposing to convert building three into a much needed grocery store for the cultural district/W 7th corridor. I believe that due to the overall demographics of the area a Whole Foods Grocery store would be ideal.

I am proposing to convert building three into a much needed grocery store for the cultural district/W 7th corridor. I believe that due to the overall demographics of the area a Whole Foods Grocery store would be ideal.

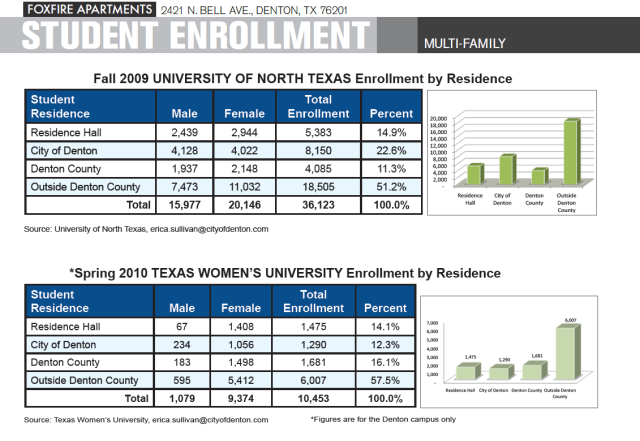

Currently the closest grocers are a Central Market and a Super Target. The Super Target is located fairly close to the proposed site behind the Montgomery Plaza shopping center. Super Target is more of a general store and I believe while it does provide groceries the area has a large enough population that a dedicated grocery store would be profitable.

Central Market (location A in the picture) is located approximately 10 minutes away and is outside of walking distance for the residences in the W. 7th corridor. (Proposed site is labeled B in the below picture.)

According to Whole Foods they require the following in order to consider a site for one of their stores:

- 200,000 people or more in a 20-minute drive time

- 25,000-50,000 Square Feet

- Large number of college-educated residents

- Abundant parking available for our exclusive use

- Stand alone preferred, would consider complementary

- Easy access from roadways, lighted intersection

- Excellent visibility, directly off of the street

- Must be located in a high traffic area (foot and/or vehicle)

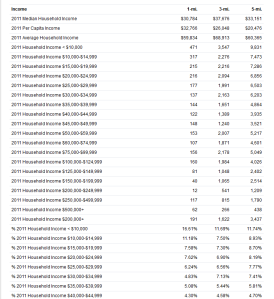

The demographics for the proposed sites area certainly fit within the stores requirement that there be 200,000 people, at least, in a 20 minute drive time area and that there be a large number of college educated residents.

The site however needs more parking for the proposed grocery store . Therefore I am also proposing to tear down part of building 2 and replace it with parking spaces.

Buildings 1 and 3 can continue to be used for the current tenants and office space.

I believe the location is close enough to the main corridor of W. 7th that the signage at the top of the building and parking garage can mitigate the fact that the store is not directly on W. 7th.

Financial Analysis

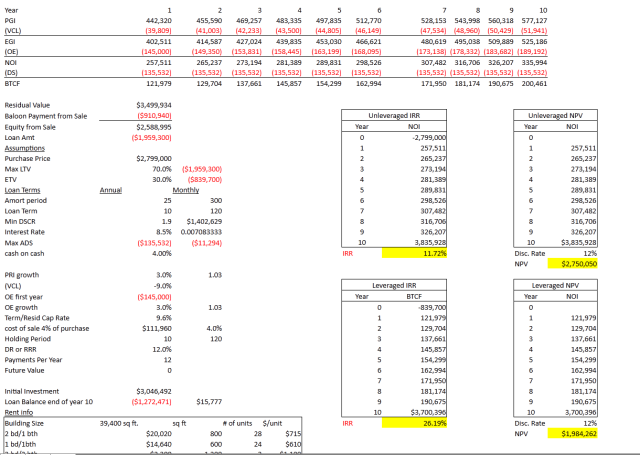

Currently retail rents in the project ranged from $30-45/SF, NNN (NNN expenses $11/SF). Office rents in the 100,000 SF office component of the W7th project were getting $25-26/SF even in the deepest parts of the recession without offering big incentives.

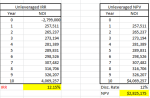

Building 2 is currently approximately 80,000 square feet. Since Whole Foods maximum space requirements are 50,000 sf I will be tearing down 30,000 sf of the current building to help make parking available for the store.

Using precast concrete panels and steel frame construction, costs per square foot will be $55.80, this plus contractor fees and architectural fees the total construction costs per sf would be $73.

So the total construction costs would be approx $3,650,000. Assuming that the expected rent would be $25 per sf the EGI would be 1,225,000, assuming a debt coverage ratio of 1.25 and an interest rate of 6% with a Maximum LTV of 80% the Maximum Supportable Total Project costs can be no more that 12,097,233.

Summary

I believe that to maximize the current layout of this site with minimum reinvestment and construction costs building 1 and 3 should remain as they are and building 2 should be converted into a Whole Foods Grocery store. Tearing down part of the building in order to increase the amount of parking which is required for the store will also add to the functionality of the site overall.

Sources: RS Means /REED Construction Data (http://www.reedconstructiondata.com/rsmeans/models/supermarket/texas/fort-worth/) Whole Foods (http://www.wholefoodsmarket.com/company-info/real-estate) Developer Feedback